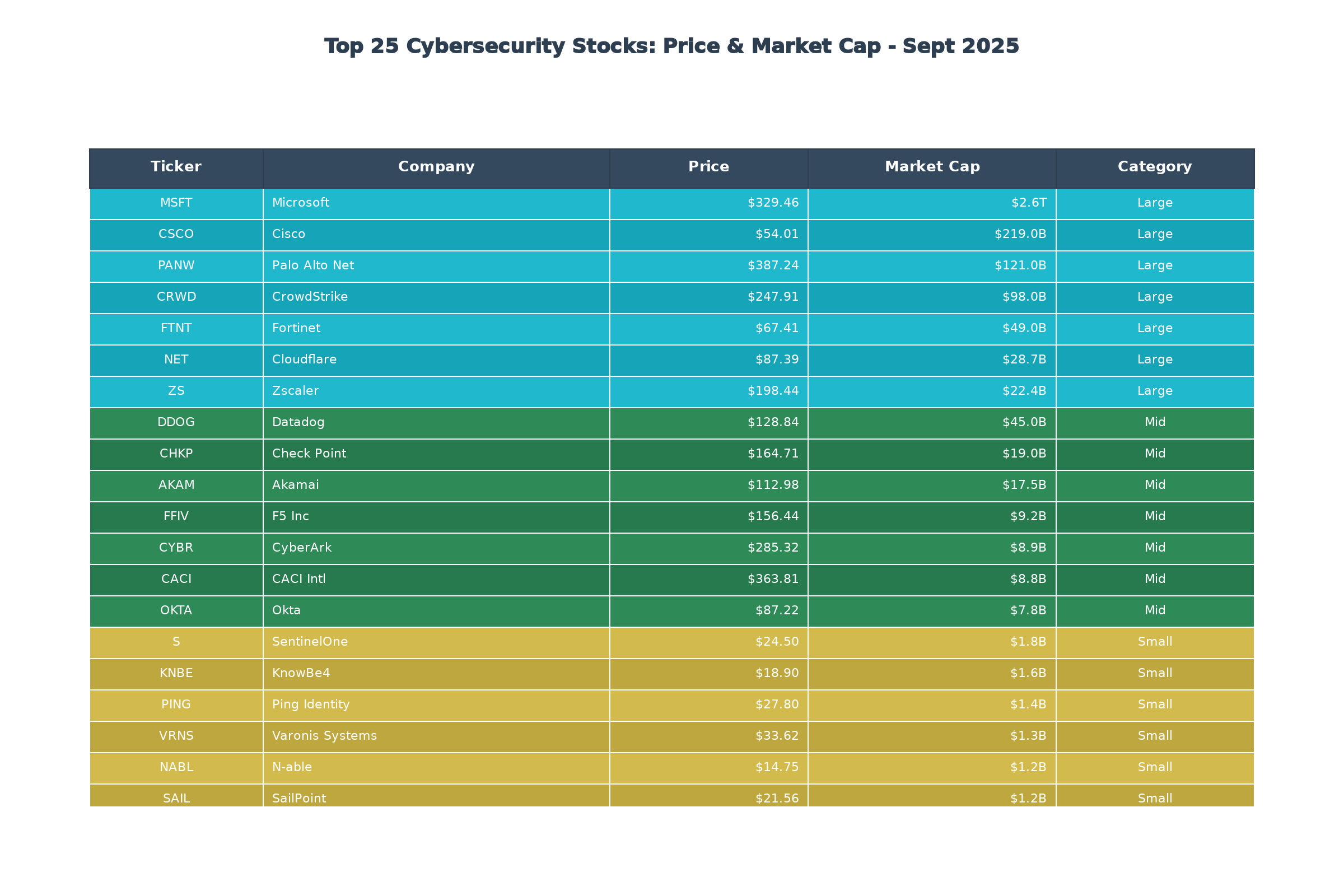

Complete Price Guide & Research Analysis for 25 Top Cybersecurity Stocks

---

---

• Business Model: Cloud-native endpoint protection platform

• Focus Area: Endpoint detection & response (EDR), threat intelligence

• Q3 2025 Highlights: 35% YoY revenue growth, expanded AI threat detection

• Business Model: Next-generation firewall & cloud security platform

• Focus Area: Network security, cloud security, security operations

• Q3 2025 Highlights: Strong platformization strategy, 28% billings growth

• Business Model: Integrated security fabric across network, cloud, endpoints

• Focus Area: Network security, secure SD-WAN, cloud security

• Q3 2025 Highlights: Record quarterly revenue, expanding OT security

• Business Model: Cloud-delivered security service edge (SSE)

• Focus Area: Zero Trust network access, cloud security

• Q3 2025 Highlights: 32% ARR growth, expanded federal presence

• Business Model: Edge computing & security platform

• Focus Area: DDoS protection, web security, edge computing

• Q3 2025 Highlights: AI security features launch, 30% revenue growth

• Business Model: Integrated cloud & security ecosystem

• Focus Area: Identity, cloud security, endpoint protection

• Q3 2025 Highlights: Security revenue up 33%, Copilot for Security expansion

• Business Model: Network infrastructure & security solutions

• Focus Area: Network security, cloud security, security analytics

• Q3 2025 Highlights: Security segment growth, AI-powered threat detection

---

• Business Model: Privileged access management (PAM) solutions

• Focus Area: Identity security, privileged access, secrets management

• Q3 2025 Highlights: SaaS transition accelerating, 25% subscription growth

• Business Model: Identity and access management platform

• Focus Area: Identity verification, single sign-on, workforce identity

• Q3 2025 Highlights: Customer identity growth, improved margins

• Business Model: Edge computing & security services

• Focus Area: Web security, bot management, edge computing

• Q3 2025 Highlights: Security revenue growth, edge platform expansion

• Business Model: Cloud monitoring & security analytics platform

• Focus Area: Application security, cloud monitoring, observability

• Q3 2025 Highlights: Security module adoption, 27% revenue growth

• Business Model: Network security & threat prevention

• Focus Area: Network security, endpoint security, cloud security

• Q3 2025 Highlights: Quantum security roadmap, stable enterprise demand

• Business Model: Application security & delivery solutions

• Focus Area: Application security, load balancing, multi-cloud

• Q3 2025 Highlights: Software transition progress, security portfolio growth

• Business Model: Cybersecurity & IoT solutions

• Focus Area: Endpoint security, automotive security, IoT security

• Q3 2025 Highlights: Automotive cybersecurity growth, IoT expansion

---

• Business Model: Identity governance & administration

• Focus Area: Identity governance, access management, compliance

• Q3 2025 Highlights: SaaS transformation, enterprise customer growth

• Business Model: AI-powered endpoint protection

• Focus Area: Endpoint detection, autonomous response, threat hunting

• Q3 2025 Highlights: Singularity platform expansion, federal wins

• Business Model: Molecular diagnostics & life sciences security

• Focus Area: Life sciences security, research data protection

• Q3 2025 Highlights: Research platform security, bioinformatics growth

• Business Model: AI-powered decision intelligence

• Focus Area: Supply chain security, defense analytics, cyber intelligence

• Q3 2025 Highlights: Defense contract wins, AI security applications

• Business Model: Security awareness training platform

• Focus Area: Phishing simulation, security training, human risk management

• Q3 2025 Highlights: Platform expansion, international growth

• Business Model: Intelligent identity solutions

• Focus Area: Customer identity, workforce identity, API security

• Q3 2025 Highlights: Cloud identity growth, enterprise adoption

• Business Model: Security operations & vulnerability management

• Focus Area: Vulnerability management, incident response, threat detection

• Q3 2025 Highlights: InsightOps growth, cloud security expansion

• Business Model: Data security & analytics platform

• Focus Area: Data protection, insider threat detection, compliance

• Q3 2025 Highlights: SaaS acceleration, data classification improvements

• Business Model: Government technology & cybersecurity services

• Focus Area: Government cybersecurity, defense technology, mission support

• Q3 2025 Highlights: Federal contract growth, cybersecurity consulting expansion

• Business Model: Secure communications & networking

• Focus Area: Secure voice/video, network security, telecom security

• Q3 2025 Highlights: 5G security solutions, government contracts

---

• Strategy: Broad cybersecurity exposure across market caps

• Holdings: Top 10 include CRWD, PANW, FTNT, OKTA, ZS

• Q3 2025 Performance: +18% YTD, outperforming tech indices

---

• AI security integration driving premium valuations

• Government spending on cybersecurity accelerating

• Cloud-native platforms gaining market share

• Identity & access management showing strong growth

• SMB security market expanding rapidly

• Persistent cyber threats ensure sustained demand

• Regulatory compliance driving enterprise adoption

• Digital transformation creating new attack surfaces

• Shortage of cybersecurity professionals benefits automation

• Geopolitical tensions increasing security spending

• High valuations vulnerable to market corrections

• Intense competition pressuring margins

• Customer concentration risks for smaller players

• Rapid technology changes requiring constant innovation

---