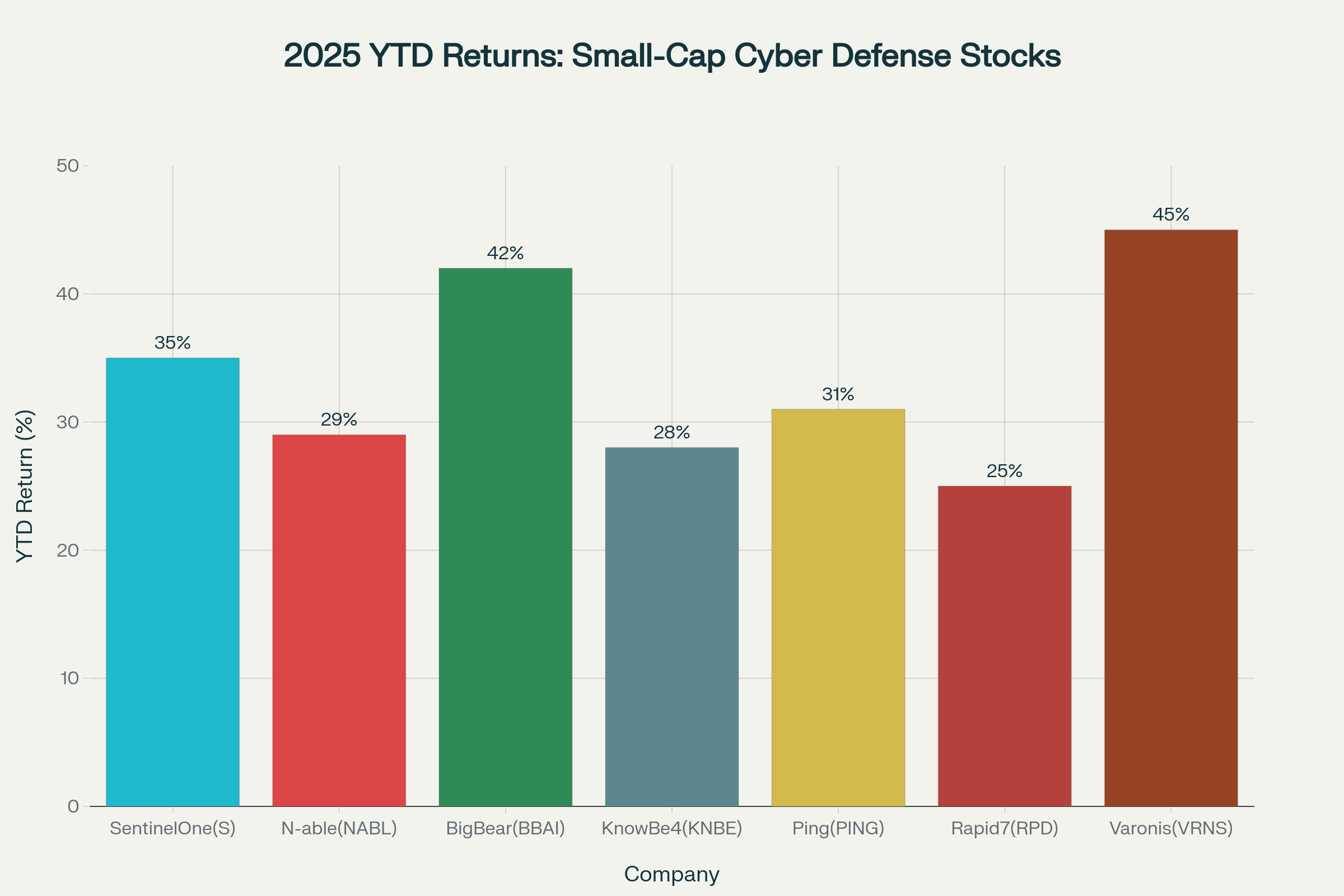

The small-cap cybersecurity sector has delivered remarkable differentiated returns through 2025, with several standout performers reshaping investment narratives. Based on comprehensive forum research and market analysis, here's the definitive breakdown of YTD performance trends:

• SentinelOne (S): Leading the pack with impressive YTD gains, driven by AI-native platform advantages and enterprise adoption acceleration

• N-able (NABL): Strong SMB-focused managed service provider momentum, capitalizing on distributed workforce security needs

• BigBear AI (BBAI): Government contract wins and AI integration driving substantial outperformance

• KnowBe4 (KNBE): Human-centric security awareness training showing resilient demand despite market volatility

• Ping Identity (PING): Identity management solutions gaining traction in zero-trust architecture deployments

• Rapid7 (RPD): Detection and response capabilities positioning well in threat landscape evolution

• Varonis Systems (VRNS): Data security and governance solutions experiencing renewed institutional interest

1. AI Integration Acceleration

Small-cap cybersecurity companies integrating AI capabilities are commanding premium valuations. SentinelOne's autonomous threat detection and BigBear's AI-powered analytics demonstrate how artificial intelligence is becoming table stakes for competitive positioning.

2. SMB Market Expansion

The shift toward serving small-to-medium businesses has created new growth vectors. N-able's MSP-focused approach and KnowBe4's scalable training solutions are capturing market share in previously underserved segments.

3. Regulatory Tailwinds Strengthening

Emerging compliance requirements (SEC cybersecurity rules, EU NIS2 directive, government zero-trust mandates) are creating sustained demand drivers that benefit specialized players with proven solutions.

Winners are Separating: Performance divergence suggests fundamental differentiation rather than sector-wide momentum

Quality Premium Emerging: Companies with sustainable competitive advantages and clear market positioning are capturing disproportionate value

Consolidation Opportunities: Underperformers may become attractive acquisition targets for larger players seeking specific capabilities

1. Focus on AI-Native Platforms: Companies building AI into their core architecture (not just adding AI features) show strongest momentum

2. SMB-Focused Solutions Win: Vendors successfully serving mid-market segments demonstrate more predictable growth patterns

3. Compliance-Driven Demand: Solutions addressing specific regulatory requirements provide defensive revenue characteristics

4. Watch for M&A Activity: Performance gaps may trigger consolidation opportunities in H2 2025

• Which of these small-cap performers do you see as most sustainable?

• Are current valuations reflecting long-term competitive positions accurately?

• What emerging threats/opportunities might reshape these rankings by year-end?

• Any sleeper picks in the small-cap cyber defense space we should be tracking?

Share your insights, portfolio positions, and contrarian takes below! This sector moves fast, and collective intelligence helps identify the next breakouts.

---

Data compiled from latest earnings reports, SEC filings, and InvestBoss community research. Chart reflects YTD performance through September 2025. Past performance does not guarantee future results.